Introduction

In a major move shaking up the global outsourcing industry, French IT and consulting giant Capgemini has announced its plan to acquire WNS (Holdings) Limited, a leading Business Process Services (BPS) provider, for $3.3 billion. This all-cash deal marks one of the biggest acquisitions in the BPS sector in 2025, underlining Capgemini’s ambition to expand its footprint in digital operations and AI-driven services.

About the Deal

According to official statements, the acquisition will help Capgemini scale its BPS offerings and strengthen its presence in key markets like the US, UK, and India. WNS, headquartered in Mumbai, has over 60,000 employees worldwide and offers a wide range of business process management solutions across industries such as banking, insurance, healthcare, and travel.

Why Capgemini is Acquiring WNS

This acquisition aligns with Capgemini’s strategic goal of becoming a leader in Data, AI, and Business Process Services. The company aims to combine its advanced technology stack with WNS’s deep domain expertise to deliver next-gen digital operations to clients globally.

Impact on the BPS Industry

Industry experts believe this mega-deal could trigger further consolidation in the BPS sector as firms race to meet the growing demand for AI-enabled process automation, customer experience transformation, and digital-first business models. The deal is expected to close in late 2025, pending regulatory approvals.

What’s Next for Capgemini and WNS

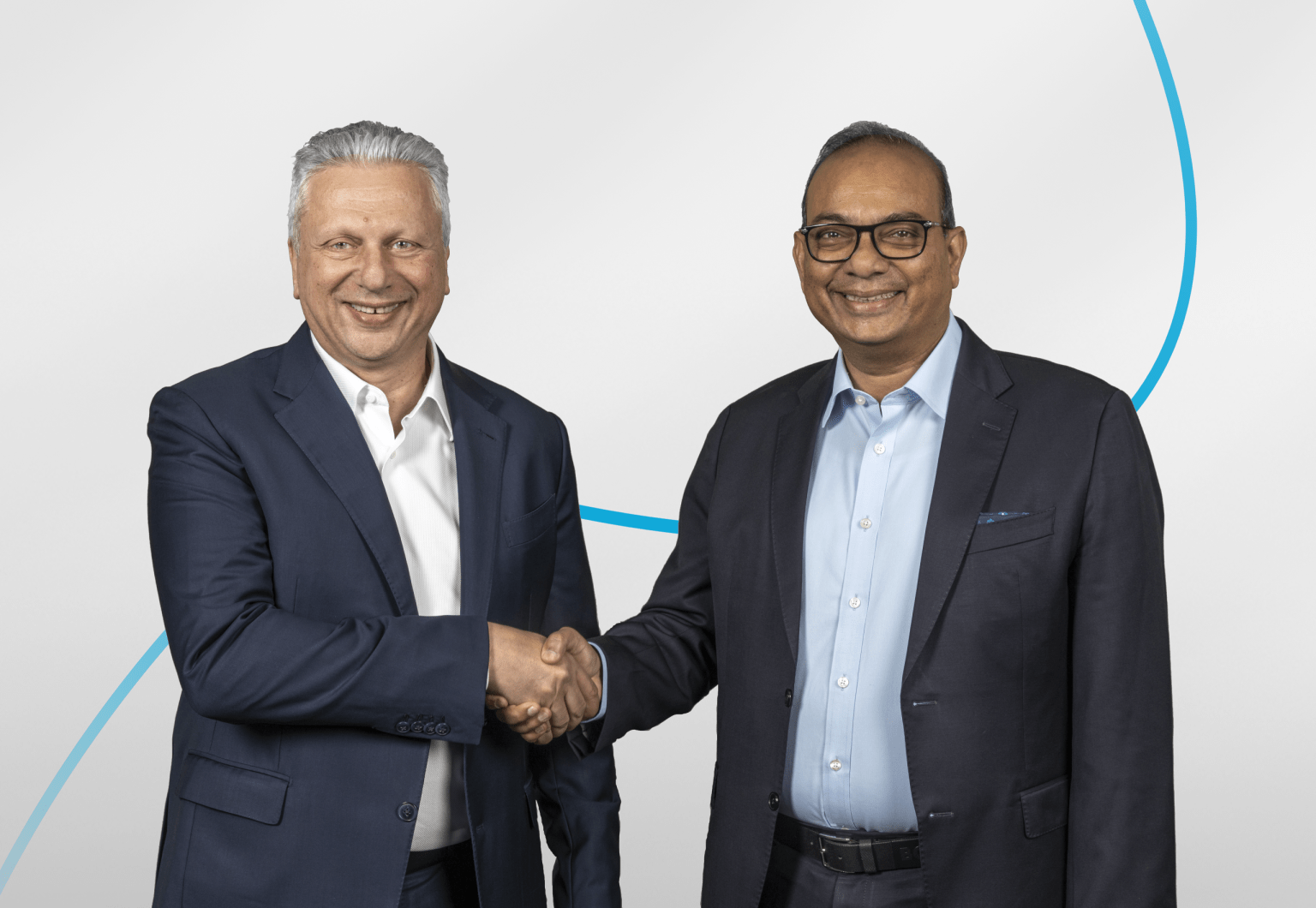

Both companies have assured employees and clients of a smooth transition. WNS’s CEO expressed optimism about the synergy, highlighting new opportunities for innovation, talent growth, and service expansion.

Key Highlights of the Capgemini-WNS Deal

Deal Value: $3.3 billion (all-cash)

WNS Employees: 60,000+

Strategic Goal: Expand AI-driven BPS capabilities

Regions Impacted: US, UK, India, and EMEA markets

Expected Closure: Q4 2025, subject to approvals

Final Thoughts

The Capgemini-WNS acquisition signals a strong outlook for the BPS industry, where digital transformation, automation, and AI will continue to drive major M&A deals in 2025 and beyond.

Stay tuned for more updates on this landmark acquisition!